The future of Taiwan manufacturing is right under our noses

-

- Mark Stocker

- Managing Director

The debate as to whether or not Taiwan should return to its past as a contract (OEM) manufacturing-focused nation—and, by default, steer away from a future focused on brands—was once again reignited with words from the Minister of Technology when he stated ‘Taiwan is better suited to doing contract manufacturing as competing as brands would only become more and more difficult going’. It’s not the first time a public official has stated that Taiwan should return to a focus on OEM manufacturing, and it serves to further highlight the continuing struggles of Taiwan’s transition to a multifaceted economy.

A quick search on Facebook for reaction to the news shows there are many, albeit mostly younger individuals, who disagree wholeheartedly with the Minister’s comments. To be fair, the Minister’s comments were made in response to the challenges facing Taiwan’s technology sector. I don’t believe he was considering other industries such as food and fashion, where some young entrepreneurs are finding success as brands.

As a brand consultant, I continue to believe that brand is the better option for companies that want to escape the continuous pricing pressure of contract manufacturing. This said, I also recognize the struggles that many of Taiwan's manufacturers, particularly those with a technology focus, have experienced in trying to transition from contract manufacturers to brand marketers.

Is there a future for Taiwan manufacturing?

If the Minister is serious about Taiwan focusing on OEM manufacturing, and that Taiwanese manufacturers have no future as brands, then at the very least he could offer up a solution to the low-profit trap that is currently being experienced by so many. I can assure the Minister that few of DDG’s clients are excited about continuing to earn a measly 3% return on their manufacturing operations.

In light of the absence of ideas from the government, I thought I would add my two cents on where Taiwanese manufacturers might look if they do decide that brand isn’t in their future.

Five years ago I was fortunate enough to work on a government-funded project that sent our team around the world to learn how Taiwan could strengthen the awareness and position of the nation's sports and leisure goods brands. This project provided a unique opportunity to look at the industry from the market perspective, and not from the typical factory-only perspective. We learned many interesting things during the project, and one insight might prove valuable to the issue at hand.

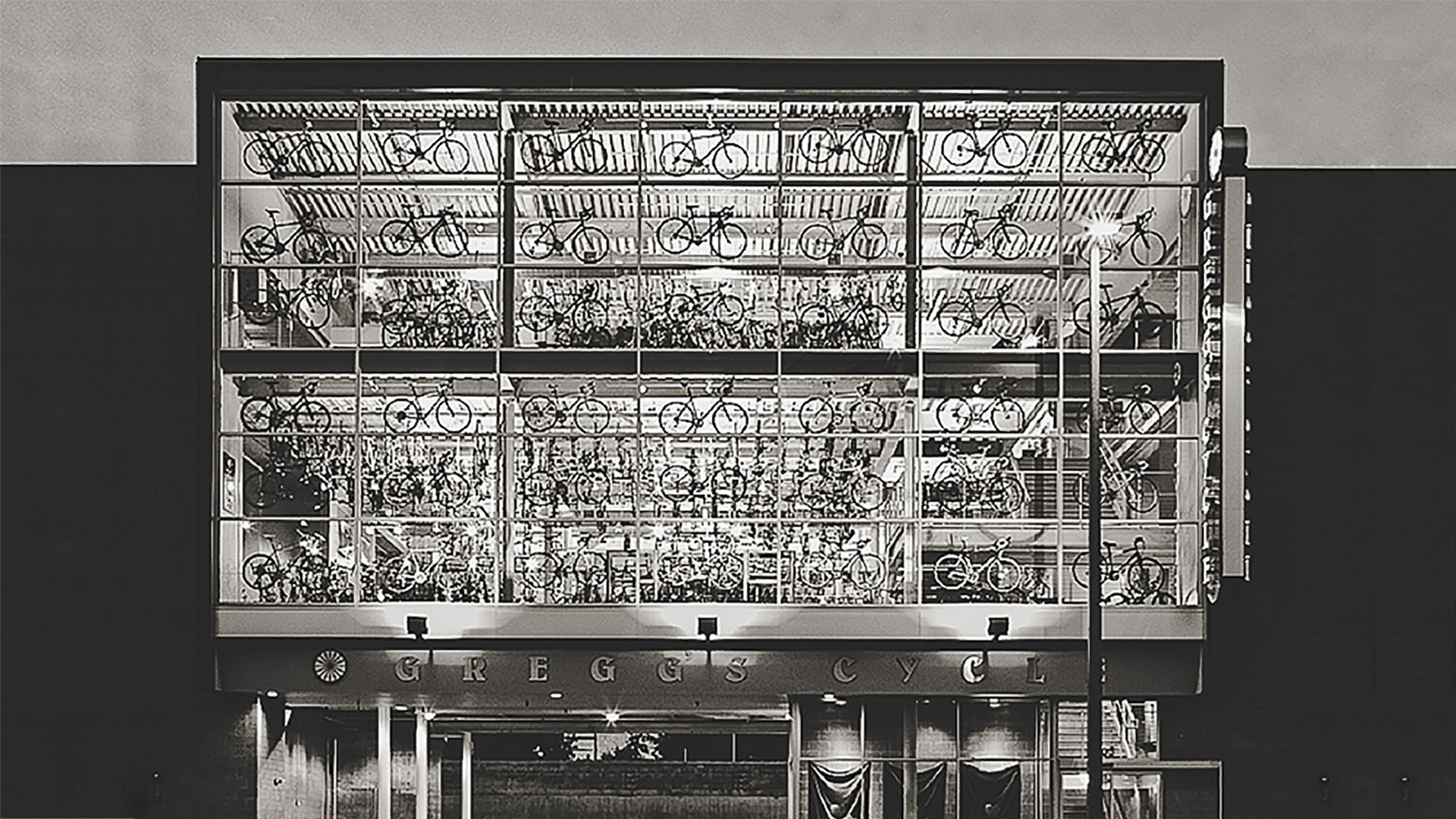

One evening, I sat across the street from a very large bicycle shop in Vancouver Canada. The shop had big glass windows, allowing me to view from outside the hundreds of bicycles hanging from the ceiling and lined across the floor of an expansive 250-ping (850sq m) retail space. Having just visited the store, I knew the bicycles on offer were not of the inexpensive kind. Quite the opposite, the bicycles in this store had an average price tag of USD2,000, and a wide selection of bicycles retailed for as much as USD10,000. I found myself asking the question: how did it become that consumers were readily willing to spend thousands of dollars on a bicycle?

Having grown up in the United States, I knew the answer to this question lay with US and European brands. Brands from these markets nurtured a culture of cycling over more than two decades, and through this investment built a large and active consumer base. These companies persuaded consumers that they should spend USD2,000 and more on a quality bicycle, and consumers obliged.

As somebody who has lived and worked in Taiwan for two decades, I also knew there was another half to the story. Taiwan's manufacturers contributed as well. They helped create this market by bringing down the cost of bicycles built with advanced materials such as carbon fiber, providing consumers with the opportunity to purchase cycling equipment that was once only reserved for professionals.

In effect, a partnership between foreign brands and Taiwanese manufacturers helped turn the consumer into a prosumer—an individual who is not a professional but who buys professional-grade goods nonetheless. It was a partnership that produced a new and highly profitable market segment.

Democratization of advanced technologies

When you stop to look at the makeup of Taiwan’s manufacturing industry you begin to realize Taiwan has achieved similar feats in other industries. The list is long: liquid crystal displays, notebooks, tablets, smartphones, indoor exercise equipment, blood pressure monitors, performance auto parts, and many more. Taiwan has been highly successful at costing down material and production technologies in order to manufacture professional-grade goods that help drive the development of prosumer market segments.

If we assume that Taiwan manufacturers’ true ability lies in costing down advanced technologies to a point that allows the average consumer to purchase a professional-grade product, then I believe Taiwanese manufacturers should make this their focus in searching for new opportunities. Near-term opportunities that might fit these parameters including hospital-grade home medical devices and home automation/robotics to name just two. Participating in the creation of the next prosumer market is the smart bet for Taiwanese manufacturers that want to continue as contract manufacturers.

I believe we all agree that there has been an over-emphasis on Taiwan as a nation of cost-down manufacturers. Yes, Taiwan has focused and even excelled at costing-down material and production technologies. But the results of these efforts are not cheap consumer goods. Conversely, products created by Taiwanese companies are expensive in relative terms and are uniquely positioned to entice consumers to switch from low-cost offerings to prosumer-grade offerings. Taiwan manufacturers are, through this process, creating new markets, and in the creation of these new markets generating the potential for highly profitable business.

Taiwan’s future is not going to be defined by one type of business model or the other. There will be successful Taiwan brands. And there will continue to be successful Taiwan contract manufacturers. For those that decide their future is in manufacturing, its time to stop thinking in simple terms (volume up, cost-down) and start looking for opportunities from the market perspective, much as I did when sitting across from that bike store in Vancouver.